Paul B Insurance Can Be Fun For Everyone

Wiki Article

Things about Paul B Insurance

Let's mean you pass away an untimely death at a time when you still have numerous milestones to attain like children's education and learning, their marriage, a retired life corpus for your spouse etc. There is a financial obligation as a real estate lending. Your untimely demise can place your household in a hand to mouth situation.

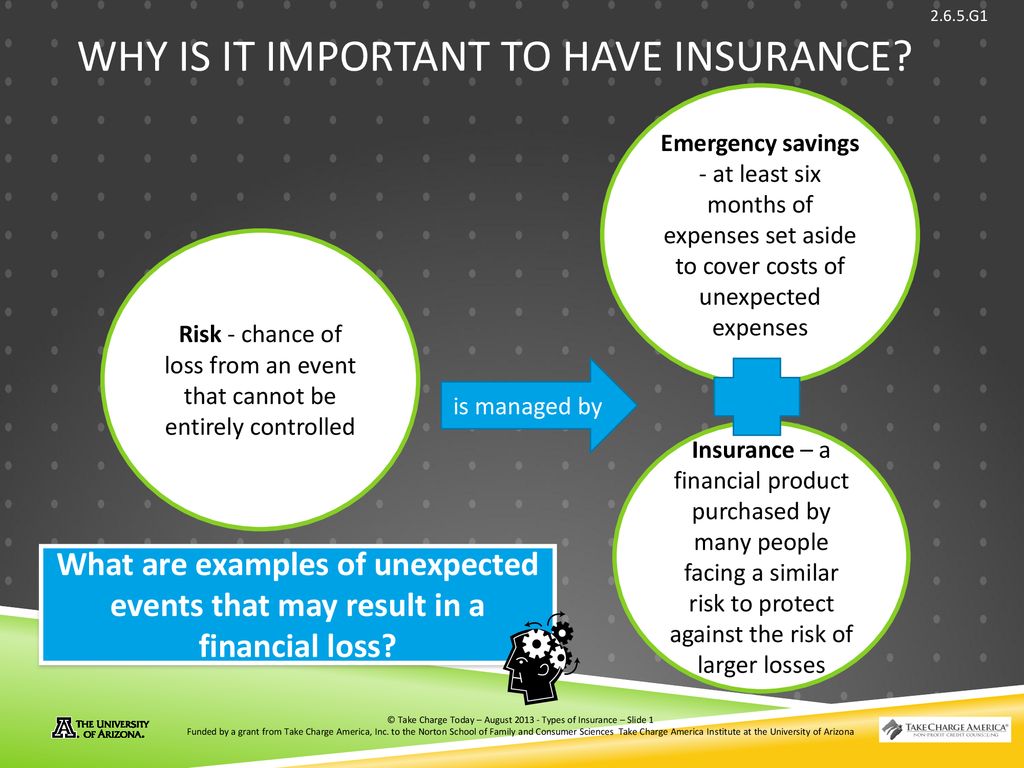

No matter exactly how difficult you attempt to make your life much better, an unanticipated occasion can entirely turn points upside down, leaving you physically, psychologically and also financially strained. Having sufficient insurance coverage aids in the feeling that at least you don't have to think of money throughout such a tough time, as well as can concentrate on recovery.

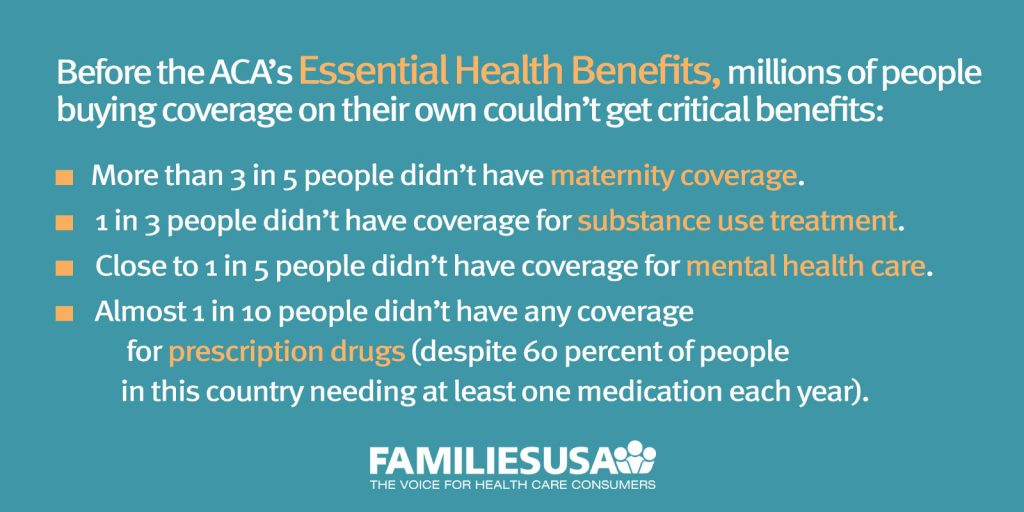

Such therapies at good hospitals can set you back lakhs. So having health insurance policy in this case, conserves you the fears and anxiety of arranging cash. With insurance coverage in position, any monetary stress and anxiety will be taken treatment of, and you can concentrate on your recuperation. Having insurance life, health, as well as responsibility is a crucial part of economic preparation.

What Does Paul B Insurance Do?

With Insurance making up a large component of the losses companies and also family members can bounce back rather quickly. Insurance coverage companies merge a large amount of cash.

Within this time they will accumulate a big quantity of wealth, which returns to the capitalist if they endure. If not, the riches goes to their family members. Insurance policy is a crucial financial tool that aids in handling the unanticipated expenditures smoothly without much problem.

There are extensively 2 types of insurance coverage and also allow us understand how either is relevant to you: Like any accountable person, you would have prepared for a comfortable life basis your earnings and profession forecast. They likewise offer a life cover to the insured. Term life insurance coverage is the pure kind of life insurance policy.

If you have a long time to retire, a deferred annuity offers you time to spend throughout the years as well as construct a corpus. You will certainly get income streams called "annuities" till the end of your life. Non-life insurance is additionally described as general insurance coverage and covers any kind of insurance policy that is outside the province of life insurance policy.

When it comes to non-life insurance policies, elements such as the age of the possession and also deductible will additionally impact your choice of insurance policy strategy. For life insurance strategies, your age and health will affect the costs cost of the strategy. If you possess an auto, third-party insurance coverage is necessary before you can drive it when traveling.

Little Known Questions About Paul B Insurance.

Disclaimer: This post is released in the public interest as well as indicated for basic information objectives just. Readers are suggested to exercise their caution as well as not to rely upon the materials of the short article as definitive in nature. Viewers should investigate additional or consult an expert hereof.

Check This OutInsurance policy is a lawful arrangement in between an insurance coverage firm (insurance company) and also an individual (insured). In this case, the insurance provider guarantees to compensate the insured for any type of losses incurred because of the protected backup happening. The contingency is the incident that causes a loss. It may be the policyholder's fatality or the residential or commercial property being damaged or damaged.

The primary functions of Insurance are: The key feature of insurance policy is to secure against the opportunity of loss. The time and amount of loss are unpredictable, and if a danger happens, the individual will certainly sustain a loss if they do not have insurance policy. Insurance coverage guarantees that a loss will be paid and also consequently safeguards the insured from suffering.

A Biased View of Paul B Insurance

The treatment of determining premium prices is also based upon the plan's dangers. Insurance provides settlement certainty in case of a loss. Better preparation as well as administration can assist to decrease the danger of loss. In danger, there are numerous types of uncertainty. Will the threat occur, when will it happen, and just how much loss will there be? Simply put, the occurrence of time as well as the quantity of loss are both unforeseeable.

discover thisThere are several secondary functions of Insurance coverage. These are as adheres to: When you have insurance policy, you have actually assured money to pay for the treatment as you receive correct financial assistance. This is among the crucial second features of insurance policy through which the general public is secured from conditions or mishaps.

The function of insurance is to relieve the stress and also suffering related to fatality and building devastation. An individual can dedicate their body and heart to far better accomplishment in life. Insurance coverage offers a motivation to function hard to better individuals by protecting society versus enormous losses of damage, devastation, as well as fatality.

Some Known Factual Statements About Paul B Insurance

There are a number of functions and also relevance of insurance policy. Several of these have been provided listed below: Insurance cash is spent in numerous initiatives like water supply, energy, as well as freeways, contributing to the nation's general financial success. Rather than concentrating on a single person or organisation, the threat affects various people and also organisations.

Insurance policy plans can be utilized as collateral for credit scores. When it comes to a house lending, having insurance coverage can make obtaining the lending from the lender less complicated.

25,000 Section 80D Individuals as well as their family members plus moms and dads (Age less than 60 years) Amount to Rs. 50,000 (25,000+ 25,000) Area 80D People and also their family plus parents (Age more than 60 years) Overall Up to Rs. 75,000 (25,000 +50,000) Area 80D Individuals and also their family(Anybody over 60 years old) plus moms and dads (Age even more than 60 years) Amount to Rs.

The Ultimate Guide To Paul B Insurance

All kinds of life insurance policy policies are readily available for tax exemption under the Income Tax Obligation Act. Paul B Insurance. The benefit is received on the life insurance plan, whole life insurance policy strategies, endowment plans, money-back plans, term insurance coverage, and System Linked Insurance Program.

Read Full ArticleEvery person has to take insurance for their wellness. You can choose from the various kinds of insurance coverage as per your demand.

Insurance policy facilitates moving of danger of loss from the guaranteed to the insurance company. The fundamental principle of insurance coverage is to spread out risk among a lot of people. A big populace obtains insurance coverage plans and pay premium to the insurance firm. Whenever a loss happens, it is made up out of corpus of funds collected from the millions of insurance policy holders.

Report this wiki page